Cost Segregation

Cost segregation supports and amplifies the benefits of 179D through accelerated depreciation and tax deferrals that enable increased cash flow for reinvestment. Like 179D, Pilotlight facilitates property assessments and conducts feasibility analysis to evaluate the potential for reallocating costs. Through Pilotlight's proprietary interface, users can easily classify building components and other structural elements and prepare detailed depreciation schedules for each asset based on the applicable tax depreciation rules.

Benefits of Cost Segregation Solution

Automated workflow

Pilotlight's cost segregation solutions revolutionize the way CPAs handle asset reclassification and depreciation analysis. By automating the workflows, Pilotlight streamlines data collection, analysis, and reporting, significantly reducing the time and effort required for cost segregation studies. Our advanced platform ensures accuracy and compliance by integrating seamlessly with existing accounting software and utilizing sophisticated algorithms to identify and reclassify assets efficiently.

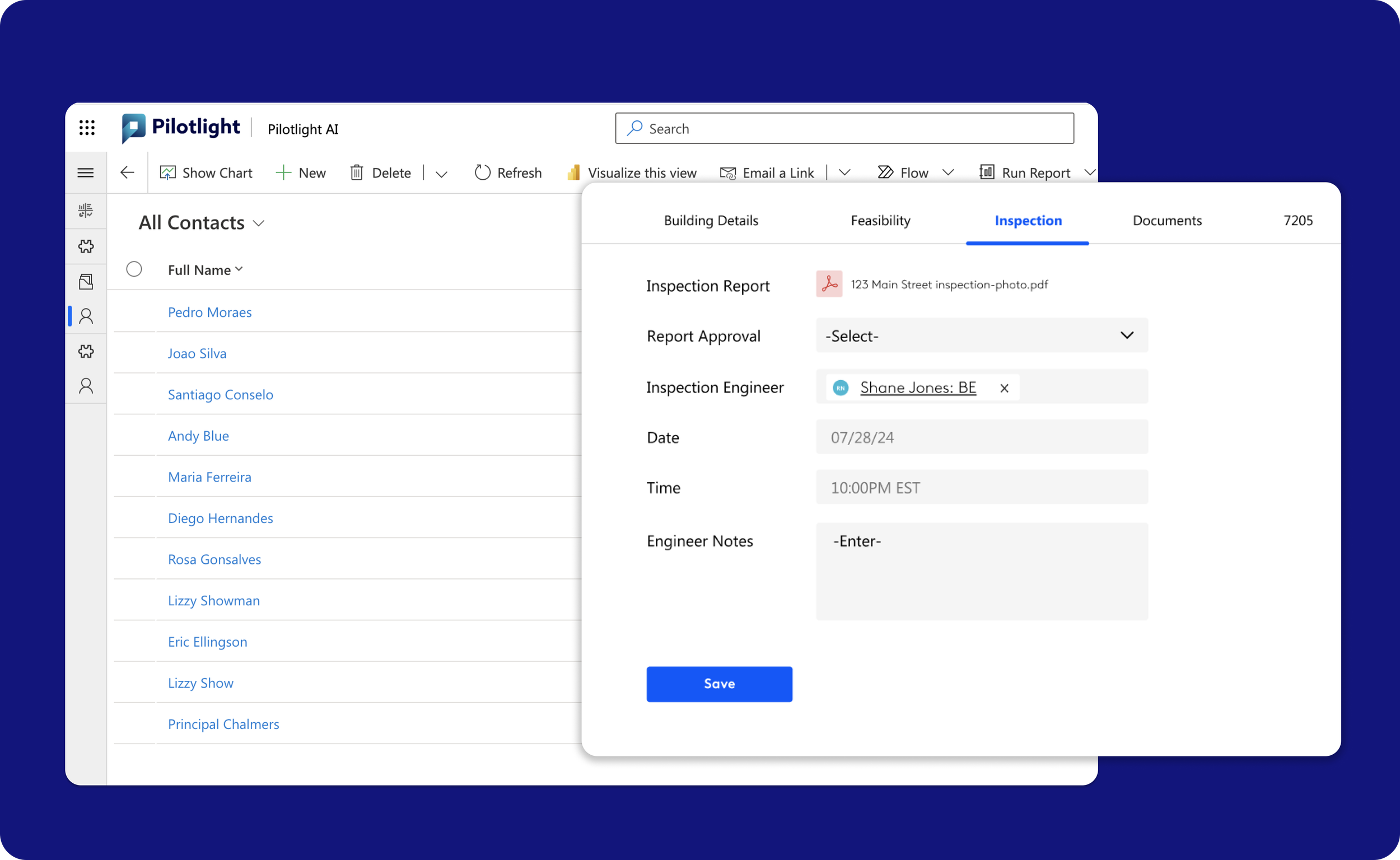

Team communication platform

Our platform provides a centralized hub for all project-related documents, ensuring that every team member has access to the latest information and can collaborate seamlessly. With integrated messaging and notification systems, Pilotlight facilitates real-time communication, reducing misunderstandings and keeping everyone on the same page.

Instantly generated estimations, & contracts

Cost Segregation solution offer a comprehensive suite of tools that streamline the generation of estimations, contracts, and essential documents. Our platform automates the creation of detailed records, providing accurate projections that clients can rely on. Additionally, it simplifies the drafting and management of contracts, ensuring that all agreements are clear, compliant, and professionally formatted.

Customizable client portal

This portal allows clients to securely upload all relevant information about their properties, including construction costs, blueprints, and renovation records. By centralizing this data, Pilotlight ensures that all necessary details are readily accessible and organized, streamlining the analysis and reporting process. This client portal not only enhances data accuracy but also facilitates seamless communication between clients and CPAs, making it easier to track project progress and ensure that every aspect of the cost segregation study is accounted for efficiently and effectively.

What is Cost Segregation?

Cost segregation is a tax strategy that allows commercial property owners to accelerate depreciation deductions, thereby reducing taxable income and increasing cash flow. At Pilotlight, our cost segregation services help CPA’s identify and reclassify personal property assets to shorten the depreciation time for taxation purposes. This results in significant tax savings and improved financial performance for our clients.

-

Cost segregation is a tax strategy that accelerates depreciation deductions by identifying and reclassifying personal property assets within a commercial building. This results in increased cash flow and reduced taxable income.

-

Owners of commercial and rental properties can benefit from cost segregation. This includes new construction, acquisitions, and renovations.

-

A cost segregation study involves a detailed analysis of a property to identify and reclassify assets that can be depreciated over shorter periods. This allows for faster depreciation deductions and immediate tax benefits.

-

Most types of commercial properties qualify, including office buildings, retail spaces, apartment complexes, manufacturing facilities, and more.

-

Savings vary based on the property type, cost, and specific assets reclassified. Typically, property owners see significant tax savings and improved cash flow.

Other Pilotlight Solutions

179D

Pilotlight's 179D solution simplifies the process of claiming energy-efficient commercial building tax deductions by automating eligibility assessment and documentation.

Investment Tax Credit

Pilotlight's investment tax credit solution simplifies the process of claiming ITCs for renewable energy projects by providing a streamlined workflow and comprehensive documentation management.

Prevailing Wage and Apprenticeship

This tool streamlines documentation and compliance processes in accordance to the Davis-Bacon Act, helping contractors and subcontractors maximize their 179D tax credits efficiently.